Walmart automated 'market fulfillment centers' extend omnichannel reach

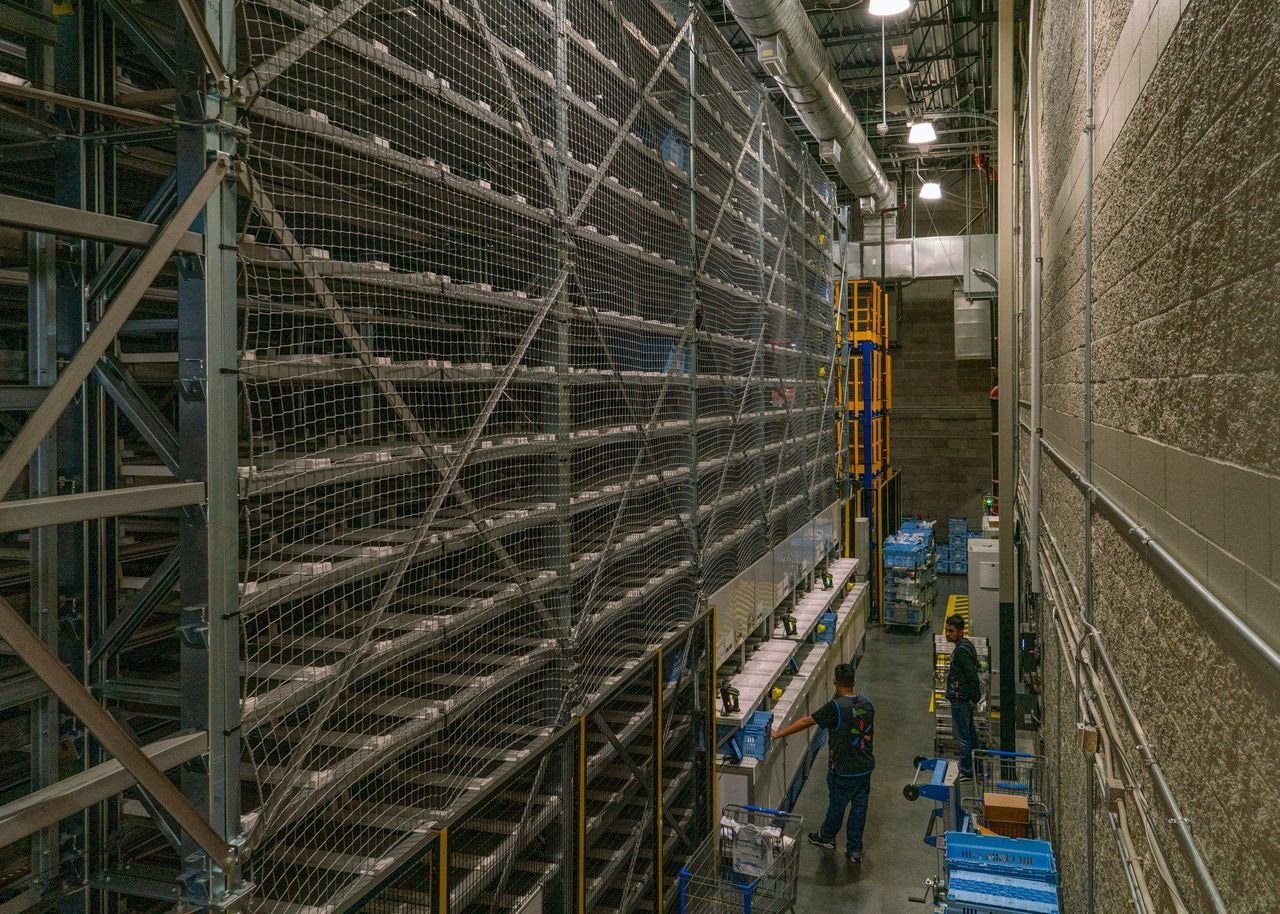

With a booming e-commerce business, Walmart is tightening its embrace of micro-fulfillment by leveraging its store space for what it calls “market fulfillment centers” (MFCs).

The MFCs, previously known as local fulfillment centers (LFCs), will serve as automated fulfillment facilities inside stores, Walmart said in a blog post this week. The retail giant noted that this model — leveraging more than 4,700 Walmart stores located within 10 miles of 90% of the U.S. population — serve as the heart of its last-mile strategy by extending its supply chain and speeding up delivery, among other benefits.

Powering the last-mile ecosystem is a technology platform that uses automation and machine learning to turn a “near-infinite number of factors” into usable data, the Bentonville, Ark.-based retailer said.

“Our new platform is doing revolutionary things,” explained Srini Venkatesan, executive vice president for Walmart Global Tech. “With all these points of fulfillment/delivery in a sense ‘communicating’ with one another, we can plan replenishment at a shorter cycle, gain close-to-real-time insights of inventory and ultimately react to customer demand. All of that adds up to a single, stellar shopping experience for Walmart customers.”

For Walmart’s fiscal 2022 fourth quarter ended Jan. 31, U.S. e-commerce sales were up 70% over two years, fueled in part by customer delivery usage expanding sixfold during the quarter versus pre-pandemic levels. Full-year digital sales climbed 11% in fiscal 2022, marking 90% growth on a two-year stack.

The need for last-mile excellence will heighten further as Walmart expands its InHome delivery service, in which groceries ordered online can be delivered directly to customers’ refrigerators. Plans call for the retailer to extend InHome’s reach from 6 million U.S. households to 30 million households by the end of 2022. To support that growth, the company said it will add more than 3,000 associate delivery drivers this year and build out a fleet of 100% all-electric delivery vans.

In August, Walmart also launched Walmart GoLocal, a white-label delivery service that offers its e-commerce and logistics capabilities to other businesses, including small to large retailers. Consumers place orders with participating businesses, their e-commerce platforms “ping” the GoLocal platform and drivers are dispatched for delivery. GoLocal distributes orders to third-party service providers via Walmart’s Spark Driver program, available in more than 600 cities. Drivers receive orders through the Spark Driver App and then complete the deliveries.

“As we continue to create new delivery options for customers and members, and new capabilities for Walmart GoLocal clients, we add density to the last mile,” stated Tom Ward, Walmart U.S. chief e-commerce officer. “With more density comes more opportunities for drivers, and more opportunities result in increased speed. This means we can get customers and clients their items even faster, all while helping lower costs.”

Walmart rival Target Corp. also has adopted a similar fulfillment strategy, which the Minneapolis-based retailer dubs “stores as hubs.” Under the omnichannel model, stores are positioned as digital fulfillment sites as well as showrooms and service centers.

Target has seen great success with that approach. More than 95% of its fiscal 2021 fourth-quarter sales were fulfilled by its stores. Same-day online services — Drive Up (curbside pickup), Order Pickup (in-store pickup) and Shipt (home delivery) — generated 45% sales growth in 2021 after a 235% gain in 2020. The company, too, opened two micro-fulfillment “sortation centers” in fiscal 2021. At these sortation facilities, which use technology acquired from Grand Junction and Deliv, backroom store staff who process digital orders focus just on picking and packing. Orders then are brought to the sortation center for collating to various carriers for delivery. Plans call for five more sortation centers in 2022.