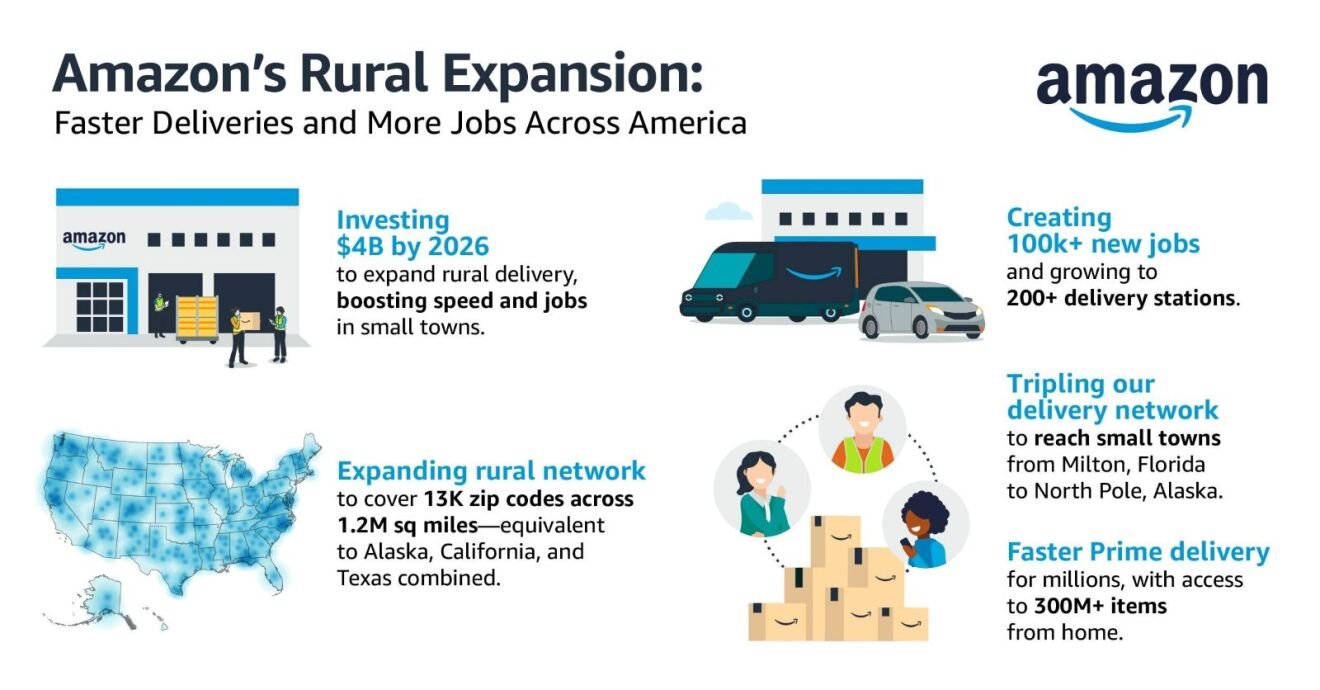

Amazon Invests $4B More to Compete with Walmart in Rural America

Amazon.com plans to build dozens of warehouses to serve rural areas in the US before the end of next year, growing its footprint as the company works to rely less on other carriers. The firm said it expects to have about 210 delivery stations up and running as part of a broad effort to establish a dedicated rural delivery network that began in 2020. It operated about 70 such facilities at the end of 2023, Amazon spokesperson Alexa Clark said, declining to specify say how many the company operates today. By the end of 2026, Amazon said, it will have invested $4 billion total in the project.

Amazon recently announced a significant investment exceeding $4 billion aimed squarely at expanding its rural delivery network across the United States**. This isn't just about adding more vans; it's a strategic play in the complex landscape of last-mile logistics, particularly noteworthy as "many logistics providers are backing away from serving rural customers because of cost to serve". For those of us focused on network optimisation and operational efficiency, this presents a fascinating case study.

Key Aspects of the Investment:

Network Footprint Expansion: The investment is set to grow Amazon's rural delivery network footprint to over 200 delivery stations**. This tripling of the rural network size is planned for completion by the end of 2026. The sheer scale is impressive, designed to serve customers in over 13,000 zip codes spanning an area larger than Alaska, California, and Texas combined.

Accelerating Delivery Speed: A primary objective is to bring "even faster delivery" to millions of customers in less densely populated areas. Amazon began scaling its small-town network in 2023 and has already observed an **average improvement in delivery speeds by 50%. The goal by the end of 2026 is to cut average delivery times in half for rural Prime members. This focus on speed in challenging geographical areas highlights a commitment to maintaining core service levels regardless of location.

Operational Models & Job Creation: The expansion leverages Amazon's existing 'last mile' network structure, which includes delivery stations located close to customers and programs partnering with individuals and small businesses. These programs include the Delivery Service Partner (DSP) program, Amazon Flex, and Hub Delivery. The investment is estimated to create over 100,000 new jobs and driving opportunities through a wide range of full-time, part-time, and flexible positions within facilities and on the road. For context, Amazon has added over 500,000 jobs in the U.S. in the last five years, with hundreds of thousands in small towns. Delivery station roles offer "an average hourly wage nearly triple the federal minimum" with benefits from day one.

Local Economic Impact: Beyond direct job creation, these investments are reported to spur additional economic activity. Recent research suggests that investments in the delivery network have already led to $500 million in economic growth in small towns and rural communities, driving GDP growth in counties where delivery stations have opened. A study also indicated that when an Amazon facility opens, median household incomes in the county increase, and poverty rates fall.

Small Business Integration: The expansion actively creates opportunities for local businesses to integrate into the delivery network through the Hub Delivery program. This allows partners, such as coffee shops and florists, to deliver Amazon packages, potentially earning up to $27,000 in incremental income annually. This model is particularly relevant for addressing the unique challenges of the rural last mile.

This strategic move underscores the critical importance of the last mile, even in areas historically considered less profitable for traditional logistics providers. Amazon's decision to significantly invest here, rather than retrench, suggests a long-term view on market coverage and customer experience as a core competitive advantage. The integration of various delivery models (DSP, Flex, Hub Delivery) indicates a flexible, layered approach to tackling the operational complexities of delivering across vast, less dense areas.