Amazon partners with GoPuff, offering 15-minute groceries

Amazon & Gopuff: Accelerating the Race Toward Instant Grocery Fulfillment in the UK

Amazon UK has just announced the nationwide roll-out of its partnership with Gopuff, the on-demand delivery specialist, following successful trials in Birmingham and Salford. This move brings thousands of snack and grocery items—including alcohol—within 15–60 minutes of Amazon customers, powered by Gopuff’s rapid delivery infrastructure.

From a supply chain and last-mile logistics perspective, this signals a meaningful shift in how Amazon is evolving its grocery fulfillment model in urban markets. Rather than relying solely on its own physical infrastructure, Amazon is increasingly leaning on deeply integrated third-party networks—from traditional grocers like Morrisons and Co-op to now ultra-fast players like Gopuff.

What Supply Chain Professionals Should Be Watching:

1. Multi-Speed Fulfillment Strategy

Amazon is clearly pursuing a tiered delivery model:

Scheduled same-day/next-day from large fulfillment centers

1–2 hour grocery from central dark stores (Morrisons, Co-op)

Sub-60-minute quick commerce from partners like Gopuff

2. Platform-as-a-Storefront

Amazon’s marketplace model is evolving beyond just product listings. It’s now acting as a gateway to other retailers’ last-mile networks, blurring the line between marketplace and logistics platform. This may challenge traditional delivery intermediaries.

3. Gopuff’s Infrastructure as a Service

Gopuff isn't just a brand; it's a rapid delivery engine that now plugs directly into Amazon's UK grocery experience. For Amazon, this could mean faster market penetration without building last-mile micro-fulfillment from scratch.

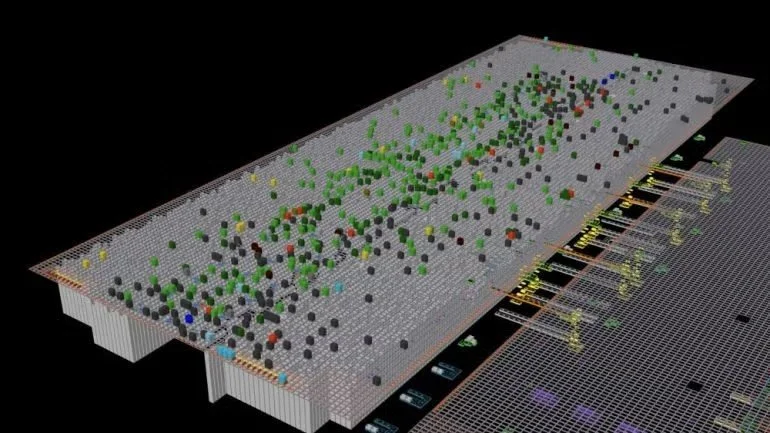

4. The Tech Behind the Scenes

What kind of inventory sync, routing optimization, and delivery orchestration is required to meet a 15-minute SLA for multiple brands inside a third-party platform like Amazon? Expect more demand for real-time orchestration software and APIs.

Strategic Implications:

Amazon’s partner network now spans:

Europe: Tegut, Dia, Knuspr, Cortilia, Monoprix

Asia: LIFE, Valor, Watson’s, Seijo

Americas & MENA: Save Mart, Lulu Group, Jüsto

This is no longer a grocery experiment—it’s a multi-national strategy built on integration, not ownership. And it may signal the future of frictionless grocery logistics at scale.

Is your company ready to integrate with platforms like Amazon, Instacart, or Uber Eats? Are your fulfillment systems fast and interoperable enough to keep up with the demands of instant commerce?

Let’s discuss where the supply chain is heading next.