Why Amazon Should Acquire Attabotics

Should Amazon Acquire Attabotics? A Strategic Move Hiding in Plain Sight

Following Attabotics' recent bankruptcy protection filing, the Canadian robotics company’s intellectual property, hardware, and remaining assets are reportedly available for just $30 million USD. This is a stunning discount for a company that once raised over $165 million and claimed it could redefine warehouse fulfillment.

But for the right buyer, these assets could offer not just a salvage opportunity—but strategic leverage.

My take: Amazon should seriously consider acquiring Attabotics.

Why Attabotics Still Matters—Even in Bankruptcy

Attabotics’ value was never in its revenue or client base. It was in its core architecture and the bold attempt to build a truly vertical, cube-based ASRS system.

While execution fell short, the underlying concept remains compelling—especially for a company like Amazon.

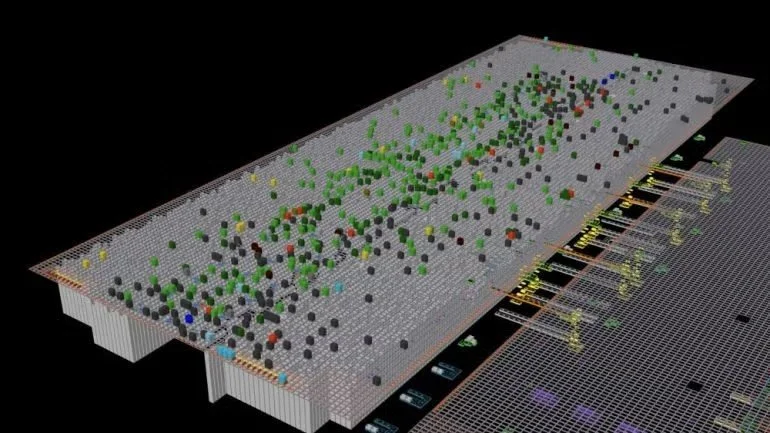

Attabotics’ system was designed to:

- Eliminate traditional aisles.

- Store inventory in a compact vertical cube.

- Use robotic “blades” that move in X, Y, and Z axes.

- Operate within smaller warehouse footprints (ideal for urban environments).

And critically: This approach aligns directly with Amazon’s push toward automated micro-fulfillment hubs closer to Prime customers.

What Attabotics Got Wrong: Software and Orchestration

As someone working in warehouse automation, I believe the biggest failure at Attabotics wasn’t the hardware—it was the software.

Despite years of funding and media attention, the company never succeeded in building:

- A robust middleware orchestration layer.

- A scalable fleet management and navigation engine.

- A real-time inventory and order routing system.

This software gap meant the system could never achieve the speed or reliability of AutoStore or Exotec. But here’s the point: Amazon doesn’t need Attabotics’ software. They already have world-class engineering talent and internal fulfillment orchestration platforms.

Why It Makes Sense for Amazon

1. Strategic Fit for Micro-Fulfillment

Amazon has spent the last two years testing compact, cube-based storage systems. The Attabotics platform fits neatly into this ongoing experimentation.

2. The Entire Company for the Cost of Two Systems

AutoStore systems typically cost $10–20 million. For $30 million, Amazon could acquire 100% of Attabotics’ assets.

3. R&D Shortcut and IP Defense

Even if Amazon never rolls out the system, owning Attabotics IP prevents competitors from leveraging it and adds defensive patents.

Tesco’s Move: A Subtle Vote of No Confidence in Attabotics Software

While Attabotics’ bankruptcy has captured headlines, many may have missed an important footnote: UK retail giant Tesco recently entered into an agreement with Attabotics to pilot a micro-fulfillment center (MFC) using its cube-based hardware platform.

Tesco reportedly committed to evaluating a single pilot installation, with the potential for up to 70 additional sites across the UK. But what’s telling: Tesco decided to purchase the hardware—but refused to use Attabotics’ software.

Instead, Tesco’s team chose to develop their own orchestration and control systems—a rare move for a retail giant.

As someone deeply involved in automation systems, I see this decision as a damning indictment of Attabotics’ software platform. In my opinion, this failure falls squarely on Scott Gravelle’s leadership. A decade after founding the company, Attabotics had still not delivered a software system trusted by tier-one customers.

Final Thought

For a company of Amazon’s scale, $30 million is a rounding error. But in the digital retail war to offer customers ever faster delivery options, it could buy them a massive head start on cube-based next-generation automated micro-fulfillment infrastructure

Attabotics may have failed as a company. But its core idea—dense, vertical, modular fulfillment—remains highly relevant. With the right engineering team and orchestration brain behind it, it could still become a valuable tool in Amazon’s ever-expanding automation playbook.