Japan and China Battle for Autonomous Forklift Supremacy

Japan's driver shortages spur innovation at warehouses as the number of people who completed courses for a forklift license is down 22% compared with the recent peak of 2008.

OMI HACHIMAN, Japan -- An engineer at Japanese forklift maker Mitsubishi Logisnext says he is receiving more inquiries from warehouse operators about self-driving models, even though they cost several times more than conventional versions. The customers say they have forklifts but cannot find operators to drive them.

While a typical midsize forklift sells for about 2 million yen ($13,300), a driverless one costs as much as 15 million yen, including the expense of installing wireless networking infrastructure within the factory. Warehouse operators used to balk at the hefty price tag, but they now see it as worth considering, said Masafumi Monchi, a product developer at Mitsubishi Logisnext.

"Some of our customers are seriously concerned about the so-called '2024 problem,'" Monchi said, referring to the stricter enforcement of overtime rules in Japan beginning April 1. Tokyo looks to promote a better work-life balance, but the move is expected to exacerbate the already severe labor shortages in logistics.

Some view such shortages as a ticking time bomb. Japan's government estimates the stricter enforcement will create a 14% shortfall in trucking capacity nationwide this year and 34% in fiscal 2030. With fewer hours worked by truckers, warehouses must handle cargo more efficiently to avoid having drivers waiting.

Mitsubishi Logisnext's self-driving forklifts emits infrared lasers a full 360 degrees and receives their reflections to check its location within the factory, while also using other sensors to detect any object in its path.

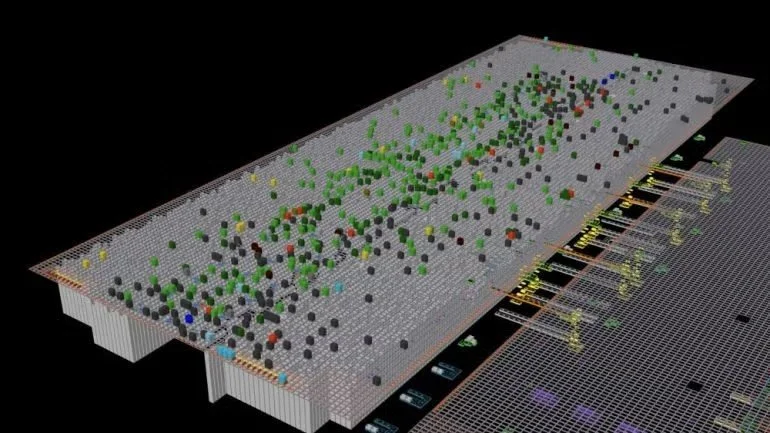

Human operators sit in the control room and give orders on moving cargo. Up to 20 autonomous forklifts work on their own, each determining a route that avoids collisions with the others. The company has improved its sensing technology enough to let the self-driving forklifts travel at the same speed as regular crewed forklifts.

Mitsubishi Logisnext also aims to develop a forklift that can lift and put down loads, using computer vision and machine learning technology, just like a self-driving car.

The current system requires warehouse operators to install sensor reflectors everywhere in the facility to guide the forklifts, which accounts for the high cost.

Sending the forklift to truck berths to pick up cargo represents another problem. Drivers never park their trucks with millimeter precision, nor place the cargo with such accuracy. The forklift needs to adjust to where the truck and the cargo are.

Self-driving forklifts are assembled at this factory in western Japan's Shiga Prefecture. Engineers are trying to make them more affordable so sales will grow.

As computer vision is less accurate than the sensor system, more development is needed. But the engineers say automation will be the only way forward as long as Japan's population keeps falling.

This potential technology would ease the workload for people and keep operations closer to schedule. It also would address the issue of truck drivers often having to spend hours waiting at warehouses without pay.

The 2024 problem is just the latest development accelerating a global shift to autonomous technology. In the U.S., interest in automating warehouses has surged in the past few years amid high inflation and rising labor costs.

The need to address labor shortages has been recognized in Japan since well before the 2024 problem.

The Magic of Packaging Automation

One factor is that fewer people pursue a career as a forklift operator. To operate a forklift, a person with a driver's license attends a lecture for a day and practices driving and operating a forklift for three days. But it takes years of practice to learn to navigate the maze-like rows of a warehouse, picking up and placing pallet loads without hitting people or damaging merchandise.

The number of people who completed courses for a forklift license in 2022 was down 22% compared with the recent peak of 2008.

Accidents and fatalities involving forklifts have stayed stubbornly high, labor ministry data shows, as experienced operators retire and leave behind younger, less experienced drivers.

Inexperienced operators are seen as more likely to cause accidents, such as by sticking the fork into the cargo instead of the pallet, damaging merchandise. They also could drop the cargo during transport or run into a wall or a person. A high rate of accidents could make the job of operating a forklift even less attractive.

Self-driving technology is seen as an answer to these challenges.

Other Japanese companies also see automation and better utilization of a limited workforce as ways to overcome the debilitating challenges.

Toyota Industries, a Toyota Motor group company and the world's biggest forklift maker, is racing to develop a self-driving forklift that can load and unload cargo from trucks arriving at warehouses.

Electronics group NEC developed a computer system that can be retrofitted into a forklift to make it autonomous. The company plans to provide the system to many forklift operators, including Mitsubishi Logisnext. NEC also is developing a computer system that lets client companies centralize the information on trucking capacity so they can use their capacity more efficiently.

Toshiba has developed a computer system for logistics facilities that traces trucks and their cargo on a screen. The system lets drivers report and seek remuneration for their services online, including via smartphone.

Hacobu, a tech company, works with Sony and warehouse operators such as Mitsui Fudosan and Daiwa House Industry to offer a check-in service for trucks and their cargo as they arrive at a logistics facility. Panasonic has developed a similar system with U.S. logistics company Penske Logistics. The solution enables automated gate management with reduced errors, Panasonic said.

The rush of activity also shows a sense of urgency among Japanese companies over the arrival of Chinese self-driving forklifts and other autonomous warehouse vehicles in Japan.

In September, Japanese visitors to Logis-Tech Tokyo 2023, a major logistics trade show, were surprised at the growing presence of Chinese exhibitors. Many of them were showcasing autonomous vehicles, including driverless forklifts. The event used to be dominated by Japanese companies.

"Chinese companies are increasing their presence each year," one of the organizers said.

Chinese manufacturers have far more offerings in autonomous vehicles than their Japanese counterparts, another organizer said. "Both Japanese and Chinese companies started developing autonomous technologies around 2018. But the Chinese are much faster in terms of product development," this organizer said.

The speed at which these Chinese startups built their presence in the forklift market has many Japanese companies viewing them as becoming more formidable rivals than their traditional Chinese counterparts who are larger in scale.

Japanese companies are starting to mimic the way these startups operate.

Mitsubishi Logisnext, for instance, has partnered with new automation startup company based in Tokyo. The two companies have developed a forklift built by Mitsubishi with a computer system supplied by the startup. Mitsubishi Logisnext also collaborates with an another Japanese startup to develop an AI camera for detecting people around a forklift.

Mitsubishi Logisnext is 64% owned by Mitsubishi Heavy Industries, but its president, Yuichi Mano, stresses that the forklift maker operates independently from the parent company.

"It is difficult to develop sensing technologies quickly if we try to do it on our own," he said. "Speed is the key to product development. We need to be agile and speedy by working with external partners."