Why America’s Largest Tool Company Couldn’t Make a Wrench in America

A highly automated Texas factory was supposed to bring the manufacturing of Craftsman mechanics’ tools back to American shores. The $90 million project was doomed by equipment problems and slow production.

A Texas-made Craftsman ratchet from Stanley Black & Decker. The company said it was closing the Fort Worth factory 3½ years after breaking ground. EVAN JENKINS

Why America’s Largest Tool Company Couldn’t Make a Wrench in America

Stanley Black & Decker built a $90 million factory on the edge of Fort Worth, Texas, intending to burnish the Made-in-the-U.S.A. luster of the Craftsman brand by forging mechanics’ tools with unprecedented efficiency. But the automated system was a bust, and the tools that were supposed to be pumped out by the million are so hard to find that some consider them collector’s items.

In March, 3½ years after breaking ground, Stanley announced it was closing the factory. The property is now being advertised for sale.

The Craftsman plant was a high-profile example of a drive among U.S. manufacturers to bring offshored plants back home. Government incentives and a desire to shorten supply chains have sparked a factory-building boom. The high cost of American labor makes automation critical for plants to turn a profit.

Turning manual tasks over to machines, which are supposed to churn out goods with minimal human involvement and maximum productivity, poses its own challenges. The Craftsman factory’s first-of-its-kind system was supposed to make tools so efficiently that costs would be on par with China, but ex-employees said it had problems that couldn’t be fixed before the company decided to pull the plug.

“It was supposed to be different,” said Tom Felty, who worked in the factory as an electroplating engineer. “It was supposed to be bringing the Craftsman brand back. It was all these new technologies. It’s why I moved from North Carolina to Texas to be a part of it, and it was an absolute disaster.”

Echoing a previous statement, Stanley blamed several factors for the plant’s closure.

“We endeavored to make Craftsman mechanics tools in a new and innovative way,” a spokeswoman said. “The events of Covid and supply chain challenges, coupled with technology that did not meet our expectations, resulted in the discontinuation of operations.”

The company declined to comment further.

The closure marked a turn for the tool maker, based in New Britain, Conn., which spent much of the past 14 years chasing growth. Stanley merged with Black & Decker in 2010 and bought Newell Brands’ tool unit in 2017. The spree turned the company into a colossus, taking it to nearly $17 billion in revenue last year, from $3.7 billion in 2009.

Craftsman, which accounted for more than $1 billion of that total, was a key part of the expansion.

Stanley Black & Decker’s now-closed Craftsman factory in Fort Worth, Texas. Photo: cooper neill

For decades, it had been a flagship brand of Sears, which contracted with U.S. manufacturers to make mechanics’ tools like wrenches, ratchets and sockets. The tools were fixtures in American homes and garages, but after Sears cut costs by shifting production to China, aficionados said the products’ quality declined. Some Craftsman wrenches, for example, fortified their open ends with extra metal, which made them hard to use in tight spaces. That earned them the derisive nickname “lobster claws.”

Stanley bought Craftsman in 2017 for $900 million, a deal then-Chief Executive James Loree said offered the chance to “re-Americanize” the brand. The company began assembling Craftsman tape measures, air compressors and other products in its U.S. facilities, packaging them with a red, white and blue logo that says “Made in the USA with Global Materials.”

The Fort Worth factory, announced in 2019, was meant to go a step further, forging the brand’s iconic wrenches, ratchets and sockets from American steel to feed a consumer desire for U.S.-made tools. Automation and other advanced manufacturing techniques would allow the plant to compete on cost with imported products, executives said.

Steve Stafstrom, Stanley’s vice president of global operations at the time, said that required devising a system that would increase both labor and material efficiency far beyond the norm.

“We had a group of folks very committed to making it work,” he said. “We had to come up with technology that had never been used before.”

Stanley was already making mechanics’ tools for the premium MAC and Proto brands at a factory in nearby Farmers Branch, Texas. Former employees said much of that work was done manually, which is standard for the industry. Workers used tongs to adjust a hot piece of metal as a press smashed it into the shape of a wrench or ratchet, and moved tools by hand from one machine to the next.

Stanley’s plan for the Craftsman plant centered on automating much of that process, as seen in a YouTube video uploaded by a Belarusian company that supplied some of the machinery.

A bar of steel called a billet was sliced from a coil by a guillotine-like device, then carried by conveyor belt through a heater. A machine rolled the glowing red billet into a shape resembling a lollipop and a robot placed it onto a press, where mechanical fingers moved it through several stations until it was pounded into a fully formed ratchet.

The video shows piles of unfinished ratchets and wrenches with scarcely any excess metal clinging to them. Ex-workers said the automated method was supposed to increase the yield well above the traditional toolmaking process, in which more than half of a billet’s steel is trimmed away.

Executives said at Stanley’s May 2019 investor day that the factory would be in production in 18 months. Former employees said that timetable, thrown off by the pandemic, meant the system wasn’t properly tested before being brought up to scale.

A former operations leader said adjustments to the Belarus-made rolling machine sometimes required new tooling to be sent from overseas, which could take weeks. He and other former employees said wrenches and ratchets became misshapen in the press. One fix would have required running the machine at half capacity, he said, but that would have thrown off the factory’s cost effectiveness.

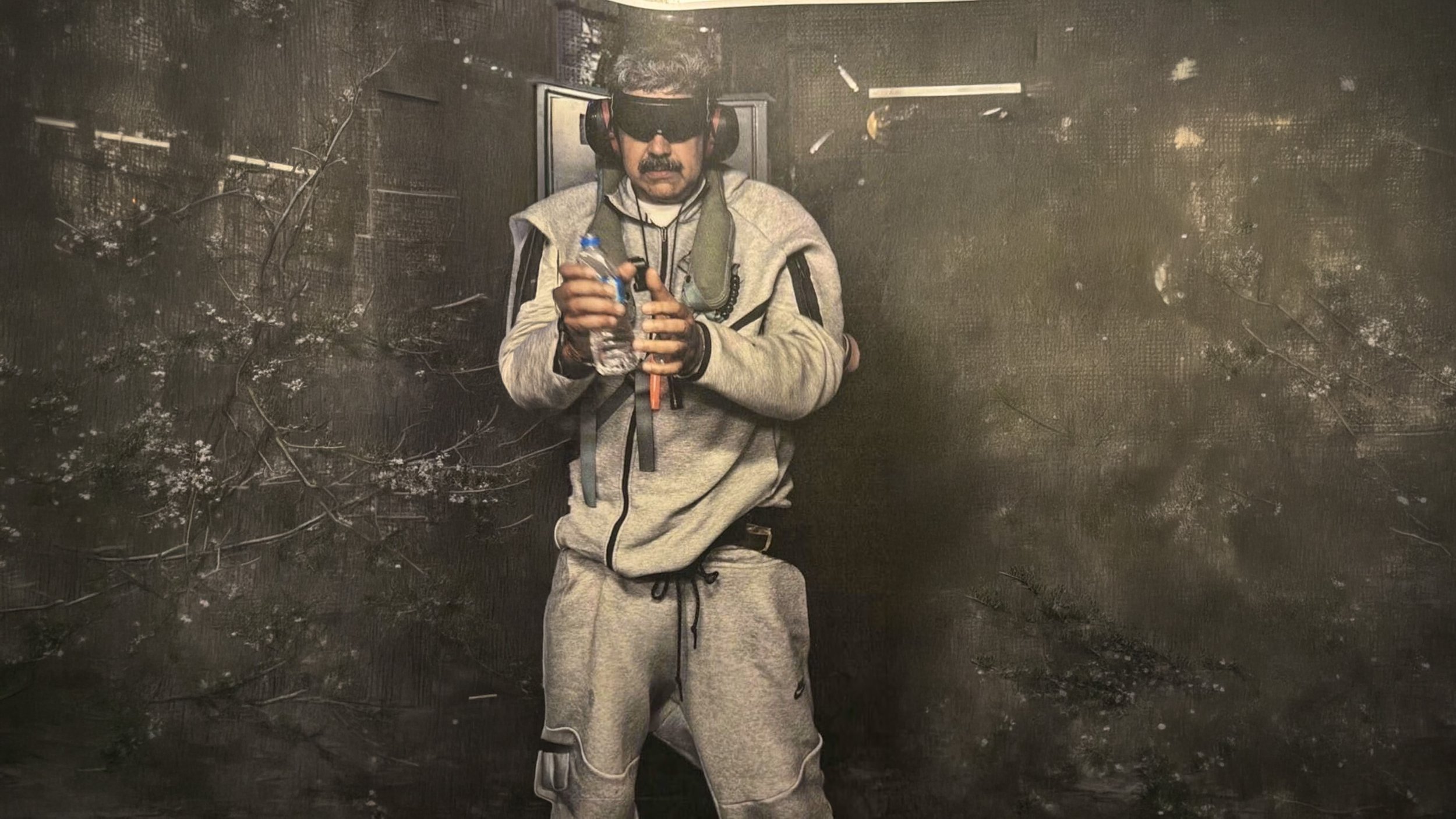

Electroplating engineer Tom Felty at his home. ‘They spent millions of dollars trying to make those machines work,’ he says. PHOTO: COOPER NEILL

Electroplating engineer Tom Felty at his home. ‘They spent millions of dollars trying to make those machines work,’ he says. Photo: cooper neill for the wall street journal

“They spent millions of dollars trying to make those machines work,” said Felty, the electroplating engineer.

The company in Belarus, AMT Engineering, couldn’t be reached for comment.

Other parts of the plant had problems, too. Jeremy Scheffer, who worked in heat treating, said sockets sometimes arrived in his section with metal that hadn’t been fully punched out, or without the Craftsman name stamped onto them.

Stafstrom, who retired in 2021, said the factory’s struggles were exacerbated by attrition among “gray-haired folks” with deep knowledge of tool making, while Felty said turnover at the top of Stanley’s tool division contributed.

Jeffrey Ansell, the company’s president of global tools and storage when the factory was announced, left that job in 2020 and has since been succeeded by four other executives. He couldn’t be reached for comment.

Despite the problems, tooling designer Greg Heltne said workers still made thousands of sockets. But retailers didn’t want them without ratchets and wrenches that also had been made in the factory, he and other former workers said.

“When the customer says, ‘I want everything I ordered’ and we can’t deliver it, there’s not much that can be done,” Heltne said.

Lowe’s, one of Craftsman’s major retail partners, declined to comment. Other retailers that sell the brand, including Ace Hardware, Amazon.com, Blain’s Farm & Fleet and Atwoods Ranch & Home Goods, didn’t respond to requests for comment.

Former workers said inventory accumulated at the factory. Scheffer said that when top executives and board members visited, he and his colleagues were told to rearrange bins of unfinished sockets so they would be less noticeable.

“There was a lot of fanfare, a lot of bigwigs checking out the plant,” tooling engineer Ronnie Cotton said. “They were just trying to show some sort of progress, but in the end, it just wasn’t working properly.”

Rival companies that make mechanics’ tools in the U.S. say their factory lines are partially automated but still rely heavily on workers’ skills.

“The artistry of the human being that’s making those wrenches—that matters,” said Wright Tool President Tom Futey, whose company manufactures high-end tools in Barberton, Ohio.

Craftsman tools forged in Texas have become collectors' items.

EVAN JENKINS

Nick Pinchuk, CEO of Snap-on, another premium brand, said that in 2010 the company’s U.S. factories had a roughly 100-to-1 ratio of workers to robots. Today it’s 8 to 1, but the gradual transition helped the company identify the optimal roles for humans and machines, he said.

“Sometimes the ease of installing automation is a little bit overestimated,” he said. “Where that comes from is, people don’t really understand how the product is made in the first place.”

Massachusetts Institute of Technology professor and roboticist Julie Shah said people often have expertise and flexibility machines can’t match. She recalled an aerospace company asking whether it could automate the work of an employee who had decades of experience heat-treating components in precise and varied ways.

“You dig into it and you’re like, ‘No, that is an extremely computationally complex problem,’ ” she said. “It’s really easy to undervalue the judgment and experience that someone brings to what seems to be like a fairly simple task.”

As tool enthusiasts wondered when Craftsman’s Texas-made products would be available, the company’s social-media accounts offered repeated assurances. In June 2022, Stanley’s Twitter account said the factory was “gearing up for its debut” and aimed to hire another 100 employees.

By then, Stanley had already announced it was divesting its security business, its oil-and-gas unit and a door-making division in a bid to become a more focused company. An earnings call in July 2022 revealed that the core tool business had suffered a sudden drop in demand after the boom times of the pandemic.

Stanley’s stock price plummeted and cutbacks became the priority as it tried to whittle down more than $6 billion of inventory. Donald Allan Jr., who became CEO last year, said the company would reduce its facilities by 30% and the number of products it sells by 40% as it sought to cut $2 billion in costs.

Some ex-employees said the Craftsman factory seemed to be getting closer to solving its production problems before Stanley began thinning the workforce. Heltne said he and a colleague were laid off this past December.

The plant, which never reached its planned staffing level of 500 employees, was down to 175 in March when Stanley announced the shutdown. The company said the same day that it was closing a plant in Cheraw, S.C., that had 182 employees who made utility knives and portable storage units, folding those operations into other factories.

Tooling designer Greg Heltne said he was laid off from the Fort Worth factory this past December. PHOTO: COOPER NEILL

Cheraw Town Manager Robert Wolfe said a few Stanley workers remain in the plant, and no buyer has materialized. Cushman & Wakefield, the real-estate firm selling the Fort Worth factory, said no deal has closed on that property.

Craftsman mechanics’ tools continue to be made in Asia, according to their packaging. Former Stanley employees said those plants have some automation but still rely on manual processing.

Allan told an investor conference in May that the company has opened new plants in Mexico to serve the North American market, and that Stanley aimed to reduce its manufacturing presence in Asia. He didn’t specify the brands or tool lines that would be included in the shift.

Goldman Sachs analyst Joe Ritchie said that the shutdown of the Fort Worth plant is a minor issue in Stanley’s overall business. Shoppers likely will take it in stride if the tools continue to be made overseas, he said, and investors are focused on the broader cost-reduction plan. Shares are up about 27% since the start of the year.

Some consumers, though, were infuriated. Jeff King, a former tech executive who hosts a YouTube review show called the Den of Tools, said his viewers’ excitement about once-beloved tools returning to U.S. production curdled into a feeling that they were misled.

“Other companies didn’t make promises to bring manufacturing back to the U.S.,” he said. “Craftsman did.”

Stanley had predicted the factory would make 60 million tools annually, but ex-employees said in the weeks after the shutdown that they weren’t sure if anything had made it to store shelves. By summer, though, domestically manufactured Craftsman socket sets began to appear at retailers.

A Wall Street Journal reporter on Monday bought an 88-piece set straight out of the shipping box at a Lowe’s in suburban Chicago. The bright red case was embossed with stars and stripes, and inside was a cardboard placard that read, “Forged in Texas.” The set cost $89.98, less than half of what some eBay vendors were seeking.

“LIMITED QTY never to be seen again,” wrote a seller who posted an identical set for $189.99.

Wisconsin carpenter Eric Jacobi got two sets through an online store that serves the military. A spokeswoman for the Army & Air Force Exchange Service said it had acquired 1,200 produced for a retailer that backed out of its purchase.

Jacobi, who runs a Craftsman fan group on Facebook, said the tools felt sturdier than their Taiwan-made equivalents, though some sockets were overly shallow and not entirely chrome plated.

Given their imperfect state and apparent scarcity, he worried that using them could damage their value as a collectible, so he heeded an online follower who advised that he lock the tools away.

“I don’t think I ever will touch these,” he said

A brief history of the wrench

‘Cut-out’ wrenches carry the names of companies whose equipment they were made to service, and are now prized by collectors. PHOTO: DON HAURY

An iron nut found in a Roman archaeological dig suggested that wrenches were being used as early as the first century A.D., according to the book “Ancient Carpenters’ Tools.”

Some of the first published images of wrenches appeared in Diderot’s Encyclopedia, published in 1771.

American workers of the early 19th century made their own crude wrenches by bending a bar of iron. Blacksmiths forged other versions until commercial production took over in the mid-19th century.

Farm-equipment manufacturers made customized wrenches to service their machines, said Don Haury, who owns more than 10,000 of the tools.

During World War II, propaganda artists used the wrench as a symbol of America’s manufacturing might.

The once-freewheeling design of wrenches has coalesced into metric and fractional sizes. That standardization of wrench sizes didn’t happen in the U.S. until 1929, Haury said.

Source: John Keilman | Photographs Evan Jenkins and Cooper Neill for The Wall Street Journal

Looking to automate every step of your supply chain? You’ve come to the right place – our one-stop automation and digitalization solutions are your ticket to the future!