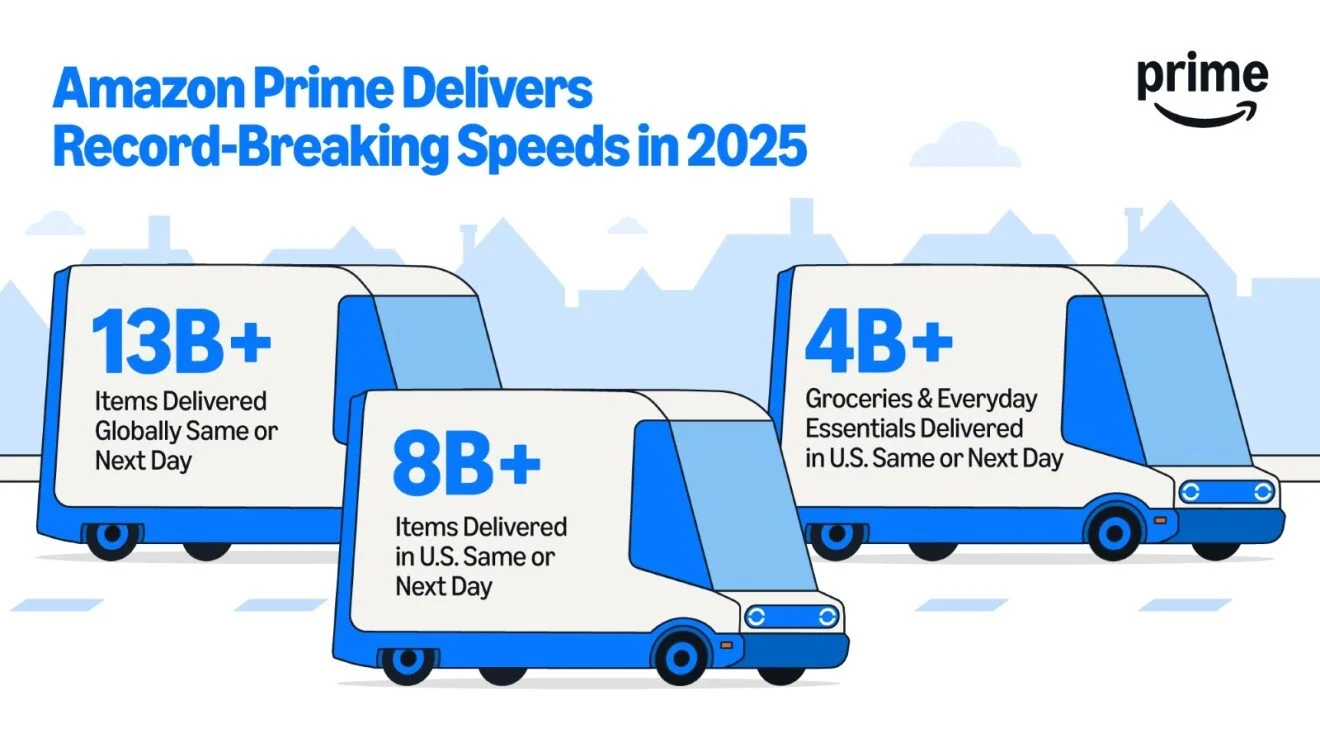

Amazon Breaks Delivery Speed Records. This Is How.

Speed Remains Amazon’s Primordial Focus

Amazon’s latest Prime delivery announcement is polished, optimistic, and carefully framed around customer convenience and employee safety. But beneath the marketing language, it reinforces a truth that has been consistent at Amazon for more than two decades:

Speed is not a feature. It is the system.

Amazon did not achieve this speed through a single breakthrough technology, a flashy robot, or a silver-bullet automation platform. It achieved it by relentlessly reorganizing its physical, digital, and organizational architecture around one core principle:

Put inventory closer to demand — and remove friction everywhere else.

Speed Is Not About Working Faster

One of the most revealing lines in Amazon’s release is also the least glamorous:

“The teams picking, packing, and driving to customers' homes are doing the exact same work for orders that arrive the same or next day as orders that used to arrive in two or more days.”

This matters.

Amazon is not asking people to move faster.

It is not “sweating the asset.”

It is not compressing labor beyond human limits.

Instead, Amazon changed where the work happens.

By reshaping its fulfillment and distribution network — smaller nodes, denser placement, tighter geographic proximity — Amazon reduced travel distance, handoffs, buffering, and dwell time. The work stayed the same. The system changed.

This is a crucial distinction that many automation programs still fail to grasp.

Proximity Beats Complexity

Same-Day Delivery now reaches more than 9,000 cities and towns across the U.S., from major metros to rural communities. That didn’t happen because Amazon built bigger megastructures or layered on more complex automation.

It happened because Amazon decomposed its network.

Smaller fulfillment footprints.

Inventory closer to demand.

Shorter last-mile paths.

Speed emerged as a byproduct of proximity — not as a direct outcome of automation intensity.

This is where many warehouse and automation strategies go wrong.

Too often, speed is pursued through:

larger centralized facilities

heavier automation stacks

tighter batching logic

higher system coupling

All of which tend to increase fragility, not resilience.

Amazon took the opposite path.

Automation Follows Architecture — Not the Other Way Around

Amazon’s press release doesn’t celebrate robots, ASRS density, or algorithmic sophistication — and that’s telling.

At Amazon, automation has always been subordinate to system architecture.

Robots don’t define the operating model.

Software doesn’t dictate the workflow.

Throughput targets don’t override physics.

Amazon executes this model on a mature goods-to-person platform — Hercules (formerly Kiva) — combined with full internal ownership of its automation and orchestration software stack.

That combination produces a critical advantage: Amazon does not need to re-slot inventory at all.

Because inventory is mobile and orchestration is fully controlled in-house, fast-moving SKUs naturally surface where they are needed most, while slower movers drift out of the way. There are no re-slotting projects, no rebalance cycles, no downtime, and no throughput penalties.

The work on the floor doesn’t change.

The system continuously adapts around it.

This is a lesson many retailers and logistics operators are still learning the hard way.

If your system requires:

heavy batching to function

long travel paths to achieve density

vendor-controlled black-box software

or heroic exception handling to maintain service levels

then speed will always be fragile — no matter how advanced the technology looks on paper.

The Real Competitive Advantage: Time

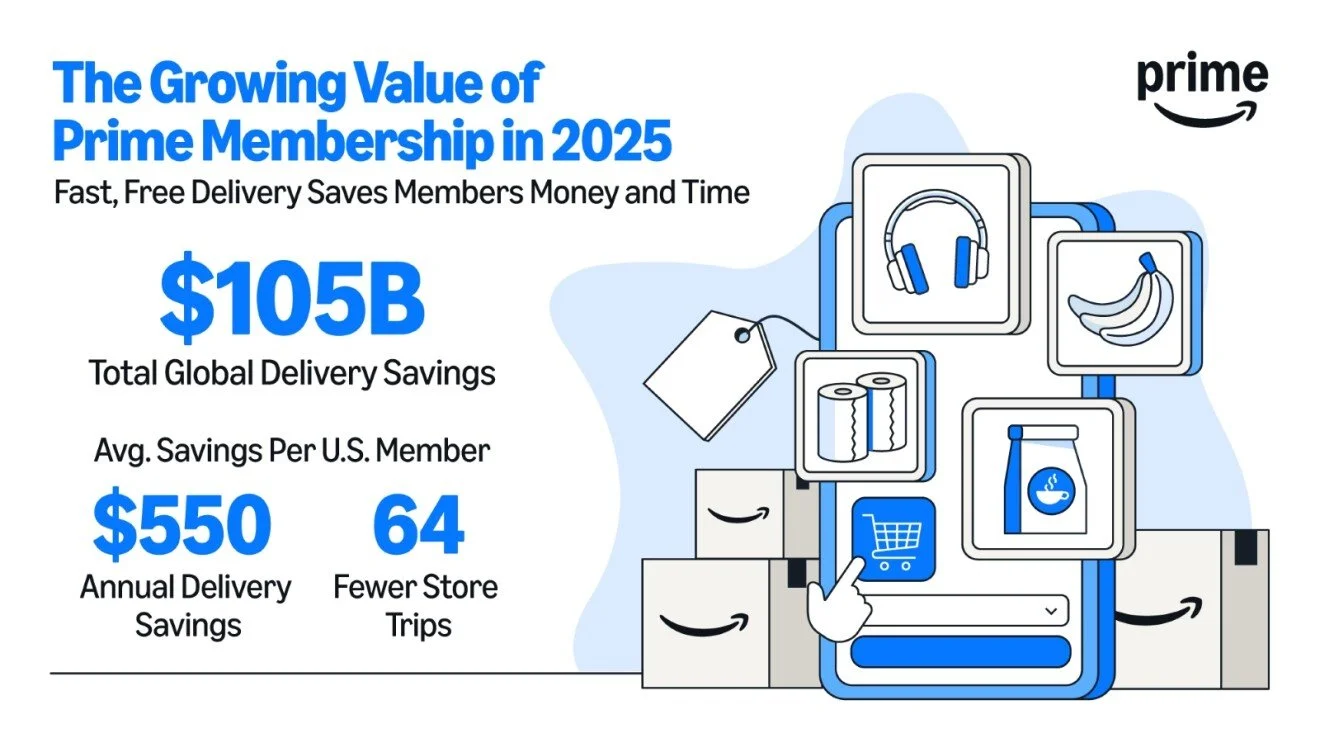

Amazon highlights that Prime members save an average of 51 minutes per shopping day compared to physical retail. That statistic is easy to gloss over — but strategically, it’s enormous.

Amazon isn’t just competing on price or convenience.

It’s competing on time recovered.

And time is the one resource customers never get back.

This is why speed remains Amazon’s primordial focus. Not because it’s flashy. Not because it’s marketable. But because time compression compounds across:

customer loyalty

order frequency

network utilization

inventory turns

working capital efficiency

Speed is not a KPI.

It’s an economic multiplier.

Final Thought

Amazon’s announcement doesn’t introduce anything radically new — and that’s precisely the point.

This is not innovation theater.

This is operational discipline, applied at scale, over decades.

If speed is the goal, the starting point is not the technology stack.

It is where inventory lives, and who controls the system that moves it.

Everything else comes later.