Why UPS Just Bought Hundreds of Truck-Unloading Robots

UPS Buys Hundreds of Robots to Unload Trucks in Automation Push

UPS recently committed $120 million to roughly 400 robotic systems designed to unload trailers and shipping containers. This was not an experimental pilot or a public-facing innovation announcement. It was a scaled purchase following years of validation.

More importantly, it targets one of the least automated — and most operationally painful — workflows in logistics: inbound unloading at the dock.

Inbound Unloading: Still Largely Manual

While sortation, storage, and picking have seen steady automation over the past two decades, truck unloading remains overwhelmingly manual across the industry.

The reasons are well known:

Loads are unstructured

Cartons vary widely in size, weight, and stability

Containers shift as they are emptied

Most facilities were never designed for robotic access

Inbound also sits at the very start of the operational chain. Any slowdown at the dock immediately cascades downstream into storage availability, picking waves, and outbound cutoffs. In practice, this makes unloading one of the most consequential — and least forgiving — workflows in a facility.

Why Pickle Met the Bar

Pickle Robot’s system focuses narrowly on this problem. It is a robotic arm mounted on a mobile base that drives directly into standard trailers and containers, lifts cartons using suction, and places them onto conveyors.

From UPS’s perspective, several characteristics stand out:

Deployable in existing warehouses

Handles cartons up to ~50 lb

Unloads a typical trailer in roughly two hours

Demonstrated payback of approximately 18 months

That final point explains the scale of the order. Large operators do not deploy hundreds of units unless the economics are already proven and repeatable.

Automation as Cost Control, Not Experimentation

This purchase aligns with UPS’s broader restructuring strategy.

In 2024, the company announced a $9 billion automation investment across more than 60 U.S. facilities, with a stated goal of $3 billion in cost savings by 2028. In parallel, UPS has closed facilities, reduced headcount, and deliberately trimmed low-margin e-commerce volume.

Within that context, inbound unloading automation serves a very specific role:

Reducing reliance on hard-to-staff dock labor

Improving throughput consistency

Lowering injury exposure and physical strain

Stabilizing operations during peak demand

UPS describes this in terms of safety and ergonomics, which is accurate. But the underlying driver is structural cost reduction.

How This Compares to Amazon, DHL, and FedEx

What makes UPS’s move particularly interesting is how different it is from other large logistics players.

Amazon has invested heavily in automation across fulfillment, but inbound unloading has remained largely manual. Amazon’s scale allows it to absorb labor volatility, and its focus has been on downstream speed, buffering, and sortation rather than dock-side robotics.

DHL has taken a more incremental approach. It has experimented with robotic unloading and mobile manipulators, but deployments tend to remain localized, often tied to specific regions, customers, or innovation centers rather than broad network-wide rollouts.

FedEx has focused more on sortation automation and network optimization than on automating inbound container unloading at scale. Where robotics are used, they are often tightly coupled to specific hub designs rather than broadly deployable brownfield solutions.

UPS’s decision stands out because it represents a scaled commitment to inbound automation inside existing facilities, rather than a selective or experimental deployment.

Executive Summary

UPS’s purchase of hundreds of truck-unloading robots is not about robotics novelty or AI signaling. It reflects a practical conclusion: manual inbound unloading no longer scales economically.

The technology reached a point where it could be deployed into real warehouses, deliver a predictable payback, and directly support a broader cost and margin strategy. By automating the very first physical workflow in logistics, UPS is addressing variability at its source — rather than compensating for it downstream.

Inbound is no longer treated as untouchable. That shift, more than the robot itself, is the real signal.

Another Ocado robotic cube warehouse goes dark. Sobeys’ decision highlights how fragile large, robot-heavy fulfillment models become when growth underperforms.

Automated Fulfillment Networks Don’t Always Expand Gracefully

Gartner forecasts that fewer than 100 companies will move humanoid robots beyond proof-of-concept.

Automation alone does not deliver sustainable performance or return on investment.

AutoStore has been positioned as the most space-dense ASRS solutions available. The claim has been repeated so often that it is rarely questioned.

The German online fashion retailer said activities at the Erfurt fulfilment site will end by September 2026.

How One Black Swan Event Ends the ASRS Speed Debate

The Simulated Frontier: How Physical AI Breaks the Automation Vicious Cycle

For years, cube-based ASRS systems — most notably AutoStore — have been positioned as the most space-dense storage solutions available. The claim has been repeated so often that it is rarely questioned.

Before You Replace Your WMS, Make Sure It Can Run Unified Commerce.

AutoStore and the Assumptions Behind Centralized Grocery Fulfillment.

The Simulated Frontier: How Physical AI Breaks the Automation Vicious Cycle

UPS Buys Hundreds of Robots to Unload Trucks in Automation Push.

Zebra Technologies is winding down its autonomous mobile robot (AMR) business, built around its $290 million acquisition of Fetch Robotics in 2021.

Kroger has announced a brand-new, $391 million automated distribution center in Franklin, Kentucky.

Kroger has taken another decisive step away from the automated fulfillment strategy it launched with Ocado in 2018.

The site in Wilcza Góra was taken from groundbreaking to operational readiness in roughly a year — significantly faster than the large Ocado CFCs launched elsewhere.

Offering high performance and excellent payload capacities, these robots makes the perfect solution for a multitude of high-payload applications.

Kroger cancels plans for additional CFCs, to pay $350M to Ocado.

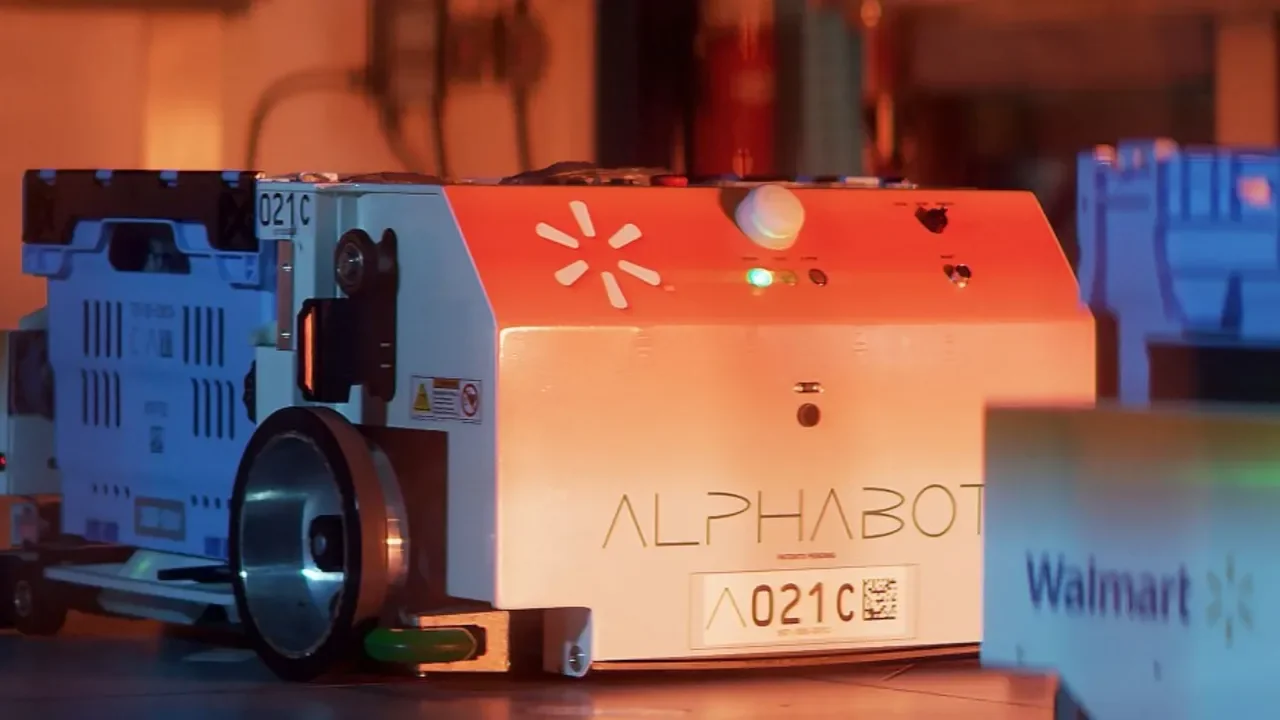

Walmart is using next-gen automation to cut a 12-step process to five and challenge Amazon on delivery speed.

Walmart’s engineers are moving away from writing every line of code and toward guiding AI-driven processes.

Watch how a full-store inventory scan can now be completed by one person in 18 minutes or less, with 100% accuracy.

Walmart’s leadership credits its momentum to one thing: using data aggressively.

The AI-supported system factors in live traffic and driver location to give customers a more accurate delivery timetable.

Why is automation underperforming? DHL’s latest data reveals the core issues.

Ocado Responds to Kroger’s CFC Closures — What Their New Statement Reveals (and What It Doesn’t).

Kroger announced that it will close three of its Ocado-powered CFCs — as it restructures its e-commerce operations.

DHL’s Insight 2030 report provides one of the most comprehensive snapshots of how supply chain leaders in North America view the next five years.

The first shipment of Locus Robotics’ new Locus Array robots has officially reached a DHL facility in Columbus, Ohio.

The super-deduction consists of a set of enhanced tax incentives meant to encourage productivity improvements, including automated and robotic equipment.