The AutoStore Density Assumption — Now Tested

The AutoStore Density Claim Meets Measured Reality

For years, cube-based ASRS systems — most notably AutoStore — have been positioned as the most space-dense storage solutions available. The claim has been repeated so consistently that it is now widely accepted as fait accompli, even by competitors across the industry.

Until recently, however, no one had the empirical data required to meaningfully challenge that assumption.

That has now changed.

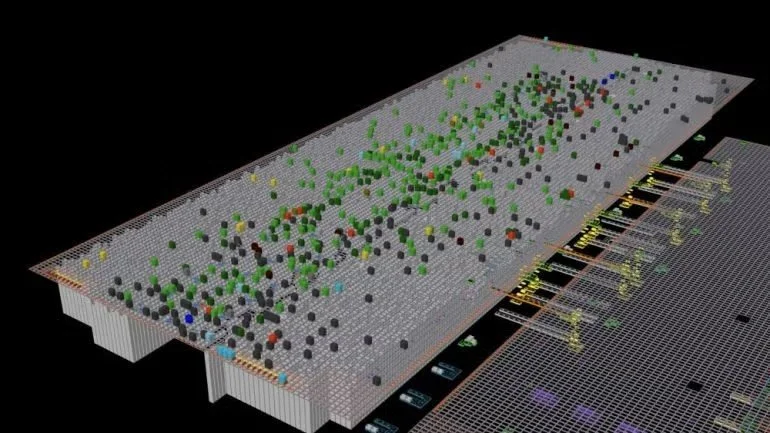

A third-party robotics company conducted a comprehensive, empirical study on a live AutoStore installation, using direct visual inspection to measure how storage volume was actually being utilized. This was not a simulation. Not a benchmark. Not inferred WMS or configuration data.

It was direct observation of physical reality.

Approximately 66,000 bin images were analyzed from a live production system. The results are statistically robust, internally consistent, and — within the automation industry — extraordinarily rare in their level of accuracy.

The findings are unequivocal:

85.8% of total bin volume was empty

More than 93% of bins were filled less than 25%

Only a negligible fraction of bins approached high utilization

These numbers are not debatable. They are not opinions.

They are measurements of what is physically inside the bins.

At this point, the discussion about storage density can no longer remain theoretical.

Why this experiment cannot be dismissed

In warehouse automation, most performance claims rest on assumptions: simulations, design models, or idealized operating conditions. This experiment avoids every common mechanism vendors typically rely on to deflect scrutiny.

It cannot be disclaimed by AutoStore, nor by its global dealer network, for straightforward reasons:

The data comes from a live production system

It is based on direct visual evidence, not inferred metrics

The sample size is large enough to eliminate statistical anomalies

The methodology measures physical reality, not configuration intent

The results are internally consistent across tens of thousands of bins

There is no credible counterargument to what the bins actually contain.

Disagreement remains possible — but only at the level of interpretation, not fact.

What this data forces us to confront

The immediate conclusion is not that AutoStore is “inefficient.”

That would be both inaccurate and intellectually lazy.

The real conclusion is more uncomfortable:

Theoretical density and effective density are no longer the same thing.

Cube systems may still be structurally dense by design. But under modern operating conditions, their realized density can diverge dramatically from their design promise — and the system itself provides no native mechanism to see or continuously measure that divergence.

A system designed for the 1990s, operating in the 2020s

Cube-based ASRS architectures were conceived in an era characterized by:

Stable SKU catalogs

Predictable demand patterns

Batch-oriented fulfillment

Store replenishment and wholesale flows

Delivery SLAs measured in days

That design context matters.

Today’s commerce environment looks very different:

Exploding SKU counts and long-tail assortments

Social- and influencer-driven demand spikes

Continuous order release

Same-day and next-day delivery expectations

Constant re-prioritization and re-slotting pressure

The system did not become worse. The operating assumptions changed.

Why AutoStore operators may intentionally sacrifice density

The bin-level underutilization revealed by the experiment is not accidental.

Operators are not failing to use the system correctly. They are actively compensating for architectural constraints.

In practice, this often includes:

Leaving bins intentionally underfilled to avoid rehandling penalties

Spreading SKUs across storage bins to reduce digging, waiting time, and workstation dwell — in order to complete orders within SLA

Duplicating inventory to protect service levels

Introducing additional slack to absorb volatility

Explicitly trading space efficiency for predictability

What appears as wasted air is often deliberate operational insurance. The system rewards stability — so operators create it, even when doing so quietly erodes effective density.

The unavoidable implication for “best-in-class density”

Once bin-level utilization is measured empirically, the density claim can no longer be absolute.

The correct statement is no longer:

“AutoStore is the most space-dense ASRS.”

It becomes:

“AutoStore can be highly space-dense under specific operating assumptions.”

That distinction is irreversible once real-world data exists.

Where cube systems can still make sense

None of this invalidates cube-based ASRS.

They remain highly effective for:

Medium- to slow-moving SKUs

Long-tail inventory

Store replenishment

Applications with relaxed or predictable delivery SLAs

They become increasingly strained when forced to operate as ultra-responsive, high-volatility, consumer-facing fulfillment engines — a role they were never originally designed to serve.

The real question buyers — and operators — should now ask

For many past, current, and future buyers, the ASRS selection process begins with a widely held assumption:

Most tier-one ASRS vendors deliver broadly comparable productivity.

Throughput, pick rates, and labor efficiency are often viewed as roughly equivalent once systems are properly sized and engineered. As a result, final purchasing decisions frequently pivot to a different differentiator.

Space efficiency.

In that comparison, cube-based systems — most notably AutoStore — are almost universally positioned, promoted, and ultimately selected as the clear winner. They are widely perceived as the most space-efficient option among all ASRS technologies, and this perception alone has driven a large number of multi-million-dollar buying decisions.

The underlying logic appears sound:

If productivity is similar across systems, then the most space-dense solution must be the best long-term choice.

But this is precisely where risk enters the decision.

Because when that density advantage is assumed rather than measured — and when internal utilization cannot be clearly observed, measured, or actively managed — the foundational premise of the investment is never fully validated.

For customers making a career-defining, multi-million-dollar ASRS decision, discovering after go-live that storage density must be deliberately relaxed — bins underfilled, SKUs spread, inventory duplicated — simply to achieve the required speed, throughput, or service levels can be deeply disappointing.

Not because the system failed. But because the original decision was anchored to a density promise that could not be sustained under real operating conditions.

Which leads to a more important question than buyers have traditionally asked.

The question is no longer:

How dense is my grid?

It is:

Do I have clear visibility into how effectively my storage volume is actually being used — bin by bin, over time — especially as operational pressure increases?

Because empty space is expensive.

And low workstation productivity erodes expected ROI and directly impacts customer delivery performance.

Empty space that remains invisible during planning, expansion, and scaling decisions inevitably leads to poor outcomes — particularly premature grid expansions, unnecessary capital deployment, and long-term system oversizing.

This experiment does not merely challenge a marketing claim.

It exposes a blind spot that has quietly shaped ASRS purchasing decisions for years — and makes the cost of that blind spot visible for the first time.