Amazon’s First Big-Box Online Fulfillment Store

What the Orland Park retail proposal reveals about Amazon’s push into Walmart-scale physical retail

Last week, Amazon presented plans to the Plan Commission in Orland Park for a proposed retail development at the intersection of 159th Street and LaGrange Road. The project calls for a roughly 225,000-square-foot, one-story big-box retail store situated on a 35-acre site, offering groceries, general merchandise, and prepared food options. While local officials emphasized that the project is retail in nature, the design includes a limited on-site warehouse component intended to support store operations and online order fulfillment.

What makes the proposal notable is not the size of the building, but how the store is intended to function. Amazon described a retail experience in which customers can shop in person while also accessing a much broader assortment through their phones or in-store kiosks. Items not physically stocked on the sales floor can be ordered and brought directly to a customer’s vehicle, either at the front of the store or in designated pickup areas. The store effectively serves as both a traditional retail destination and a local fulfillment point for online orders, without being positioned as a regional distribution facility.

This approach represents a meaningful shift in how Amazon is thinking about physical retail. Rather than treating stores as standalone destinations or as lightweight pickup points, the Orland Park proposal integrates retail and fulfillment into a single, purpose-built format. Inventory visibility, customer access, curbside pickup, and back-of-house operations are all designed together, suggesting that fulfillment is being treated as core infrastructure rather than a secondary add-on.

At this scale, the strategy directly overlaps with a model that Walmart has refined over decades. Walmart’s advantage has long been its ability to use large-format stores as both shopping destinations and fulfillment nodes for e-commerce. Amazon has experimented with many physical formats in the past, but this proposal marks one of the first attempts to challenge that advantage using a full big-box footprint rather than smaller, specialized concepts.

The understated nature of the proposal is also worth noting. There are no claims about breakthrough technology or radical new operating models. Instead, the focus is on circulation, access management, separation of customer and delivery traffic, and on-site operations that support both walk-in shoppers and online customers. That restraint suggests a recognition that store-based fulfillment only works when it is designed into the building and remains largely invisible to the customer experience.

If approved, construction could begin as early as this spring, but the broader implications extend well beyond a single location in suburban Illinois. The Orland Park project provides a clear view into how Amazon may approach physical retail going forward: large-format stores designed from the outset to serve both in-store demand and local online fulfillment, without forcing one to dominate the other.

Ocado has delivered a cube-based automation system for McKesson Canada, representing a continued expansion of its technology beyond e-commerce grocery fulfilment.

The prominent robotics startup entered bankruptcy protection in July after raising more than $200 million dollars from investors.

Another Ocado robotic cube warehouse goes dark. Sobeys’ decision highlights how fragile large, robot-heavy fulfillment models become when growth underperforms.

Automated Fulfillment Networks Don’t Always Expand Gracefully

Gartner forecasts that fewer than 100 companies will move humanoid robots beyond proof-of-concept.

Automation alone does not deliver sustainable performance or return on investment.

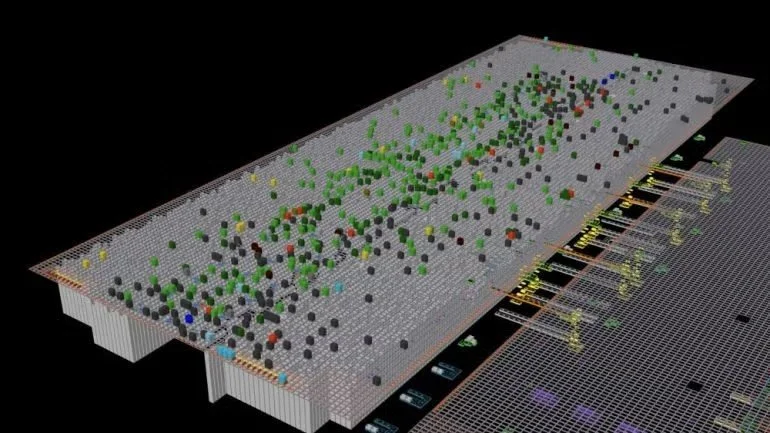

AutoStore has been positioned as the most space-dense ASRS solutions available. The claim has been repeated so often that it is rarely questioned.

The German online fashion retailer said activities at the Erfurt fulfilment site will end by September 2026.

How One Black Swan Event Ends the ASRS Speed Debate

The Simulated Frontier: How Physical AI Breaks the Automation Vicious Cycle

For years, cube-based ASRS systems — most notably AutoStore — have been positioned as the most space-dense storage solutions available. The claim has been repeated so often that it is rarely questioned.

Before You Replace Your WMS, Make Sure It Can Run Unified Commerce.

AutoStore and the Assumptions Behind Centralized Grocery Fulfillment.

The Simulated Frontier: How Physical AI Breaks the Automation Vicious Cycle

UPS Buys Hundreds of Robots to Unload Trucks in Automation Push.

Zebra Technologies is winding down its autonomous mobile robot (AMR) business, built around its $290 million acquisition of Fetch Robotics in 2021.

Kroger has announced a brand-new, $391 million automated distribution center in Franklin, Kentucky.

Kroger has taken another decisive step away from the automated fulfillment strategy it launched with Ocado in 2018.

The site in Wilcza Góra was taken from groundbreaking to operational readiness in roughly a year — significantly faster than the large Ocado CFCs launched elsewhere.

Offering high performance and excellent payload capacities, these robots makes the perfect solution for a multitude of high-payload applications.

Kroger cancels plans for additional CFCs, to pay $350M to Ocado.

Walmart is using next-gen automation to cut a 12-step process to five and challenge Amazon on delivery speed.

Walmart’s engineers are moving away from writing every line of code and toward guiding AI-driven processes.

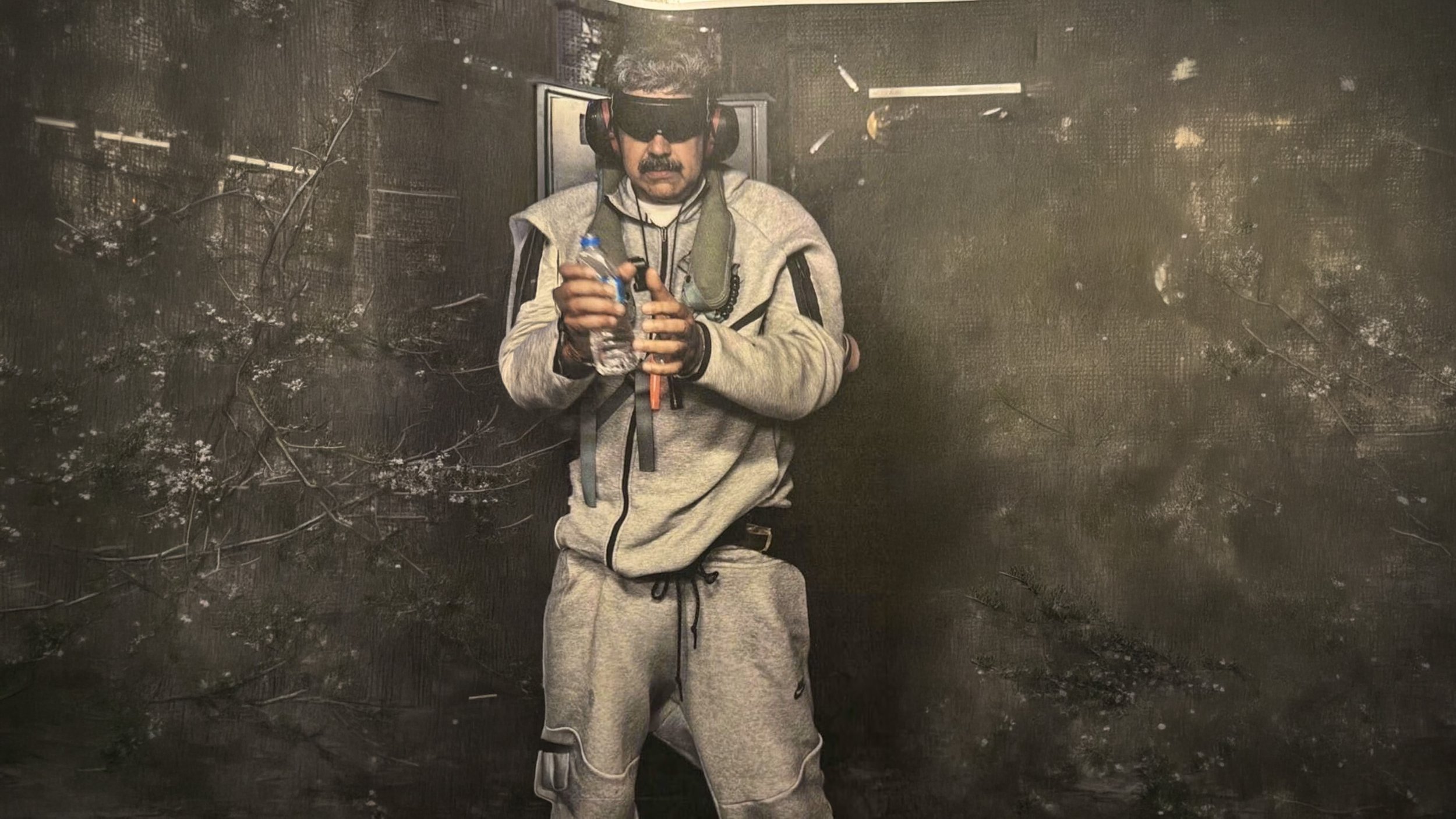

Watch how a full-store inventory scan can now be completed by one person in 18 minutes or less, with 100% accuracy.

Walmart’s leadership credits its momentum to one thing: using data aggressively.

The AI-supported system factors in live traffic and driver location to give customers a more accurate delivery timetable.

Why is automation underperforming? DHL’s latest data reveals the core issues.

Ocado Responds to Kroger’s CFC Closures — What Their New Statement Reveals (and What It Doesn’t).

AutoStore reported its 2025 results this week, outlining a year that moved from early caution to clear second-half acceleration.