Why Amazon Is Testing a 30-Minute Micro-Fulfillment Strategy — and What It Means for Retailers

How a proximity-based micro-fulfillment model could reshape delivery speed, cost efficiency, and consumer expectations.

When Amazon announced it is now testing 30-minute delivery for essentials and groceries in parts of Seattle and Philadelphia, it wasn’t simply another expansion of Prime convenience. It signaled something larger: Amazon and Walmart are entering a delivery war the U.S. market has never seen before.

This isn’t about offering “fast delivery” anymore.

This is about minute-level logistics, new micro-fulfillment models, and two retail giants racing to redefine how quickly a household can receive milk, medication, snacks, pet food, or a forgotten cable.

And the race is accelerating.

Amazon’s Latest Move: Delivery in ~30 Minutes

Amazon’s new service — Amazon Now — offers thousands of essential products with delivery times measured in minutes:

Fresh groceries (milk, eggs, produce)

Household goods

OTC medications

Paper products

Cosmetics

Pet items

Electronics and seasonal items

Key details:

Available today in select areas of Seattle and Philadelphia

Prime members see fees starting at $3.99

Non-Prime fees begin at $13.99

Orders under $15 add a $1.99 basket fee

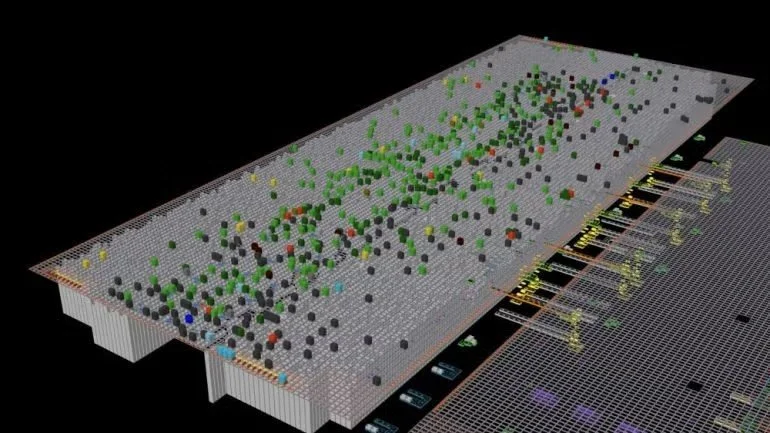

Fulfilled from specialized, small-format facilities located very close to residential clusters

Staffed and routed as Amazon’s “fastest delivery operation”

Fully integrated inside the standard Amazon app (look for the “30-Minute Delivery” option)

The model is specifically built for single-item, impulse, and urgent purchases, a category with high repeat potential and strong margin dynamics once density is optimized.

Why Amazon Is Doing This Now

The clues are in their recent logistics strategy:

Over 1,000 cities already have same-day perishable grocery delivery

Expansion planned to reach 2,300 cities by year-end

Increased investments in predictive AI, routing, and regionalized fulfillment

Rapid placement of smaller, proximity-based facilities

Amazon is betting that the future of delivery will look less like “order a cart of groceries once a week” and more like:

“I need two things right now — and I want them at my door in under 30 minutes.”

That is the battlefield Amazon wants to dominate.

Meanwhile: Walmart Has Quietly Been Building Its Own Minute-Level Delivery Capabilities

This launch comes at a moment when Walmart is aggressively reshaping its own delivery infrastructure:

Walmart is testing minute-level delivery windows

Rolling out live, real-time order updates

Expanding store-based fulfillment at unprecedented speed

Using vibe coding and AI-assisted engineering to develop new workflows within hours

Building deeper integrations between Walmart+, robotics, and in-store automation

Scaling delivery density powered by 7,000+ stores, many positioned closer to customers than Amazon’s FC network

Walmart has a structural advantage almost no other retailer has:

their stores effectively function as micro-fulfillment centers in every major city and town.

And they are now fully leveraging that advantage.

Why This Is Becoming a Delivery War

For the first time, both companies are pushing toward the same endpoint:

1. Delivery measured in minutes

Not days, not hours — minutes.

2. Ultra-dense micro-fulfillment infrastructure

Smaller hubs, closer to customers, optimized for 1–4 items.

3. Real-time visibility

Amazon offering minute-by-minute tracking.

Walmart testing up-to-the-minute delivery time updates.

4. System-level automation and AI

Both companies are deploying automation, robotics, orchestration layers, and predictive AI to raise throughput and reduce cost per order.

5. A fight for habitual buying behavior

If customers get used to “I tap a button, and it arrives in 20–30 minutes,” the winner becomes the default channel for essential goods.

This isn’t just a convenience race.

It’s a fight for the future shape of household purchasing behavior.

What This Means for Other Retailers

Most retailers cannot match:

Amazon’s logistics footprint

Walmart’s store density

Either company’s automation and engineering capability

But the shift still affects everyone.

Consumers will begin expecting:

Real-time delivery windows

Faster service for small baskets

Consistent accuracy

A seamless, app-native experience

Inventory visibility they can rely on

Retailers that cannot meet these expectations will fall behind — not because they lack products, but because they lack infrastructure, orchestration, and delivery precision.

Closing Thoughts

Amazon’s 30-minute “Amazon Now” test is more than a pilot.

It’s a sign that the largest retailers in the U.S. are preparing for a logistics landscape defined by:

proximity fulfillment

hyper-fast last-mile

tightly orchestrated automation

and service measured in minutes

Walmart is already signaling similar capabilities.

Amazon is pushing hard in the same direction.

A delivery war is underway — and the winner will shape how North Americans shop for everyday essentials.

AutoStore reported its 2025 results this week, outlining a year that moved from early caution to clear second-half acceleration.